A Home for Every Child

On Investing in Real Estate to Fund a College Education

The Cost of College

According to US News, the average college tuition for the 2023-2024 year was $42,162. For four years, that totals $168,648, not including housing, food, transportation, books, and other school-related expenses. Worse still, those costs are increasing faster than inflation. In the last 20 years, tuition and fees at private universities have increased 132%, or 40% when adjusted for inflation, while in-state tuition for public universities has increased by 158%, or 56% when adjusted for inflation. Many students will graduate with a heavy burden of student loan debt.

Option 1: Save the Old-Fashioned Way

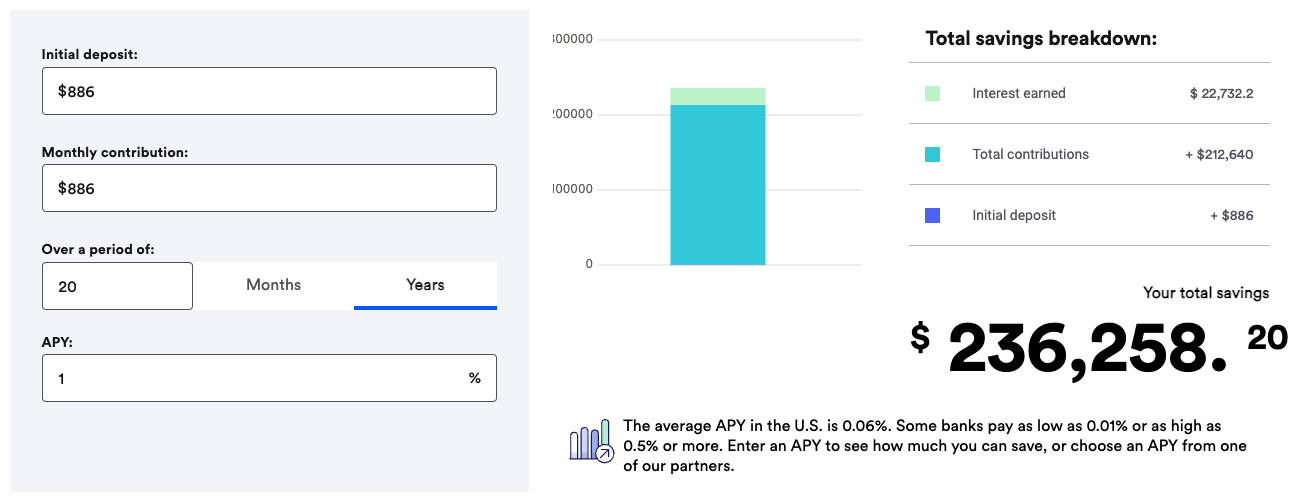

Assuming a 1% interest rate in your savings account, you would have to invest $886 per month for 20 years to accumulate $236k. Keep in mind the $236k does not include housing at that the average interest rate for savings account is 0.06%, not 1%!

Source: Bankrate

The parent, after saving $212,640, could write a check for college and would have zero dollars left over.

Option 2: Invest in the Stock Market

Instead of depositing the money into a savings account, the parent could invest in the stock market. Per the recommendation of their financial advisor, they invest in an index fund that tracks the entire Dow Jones index instead of selecting individual stocks.

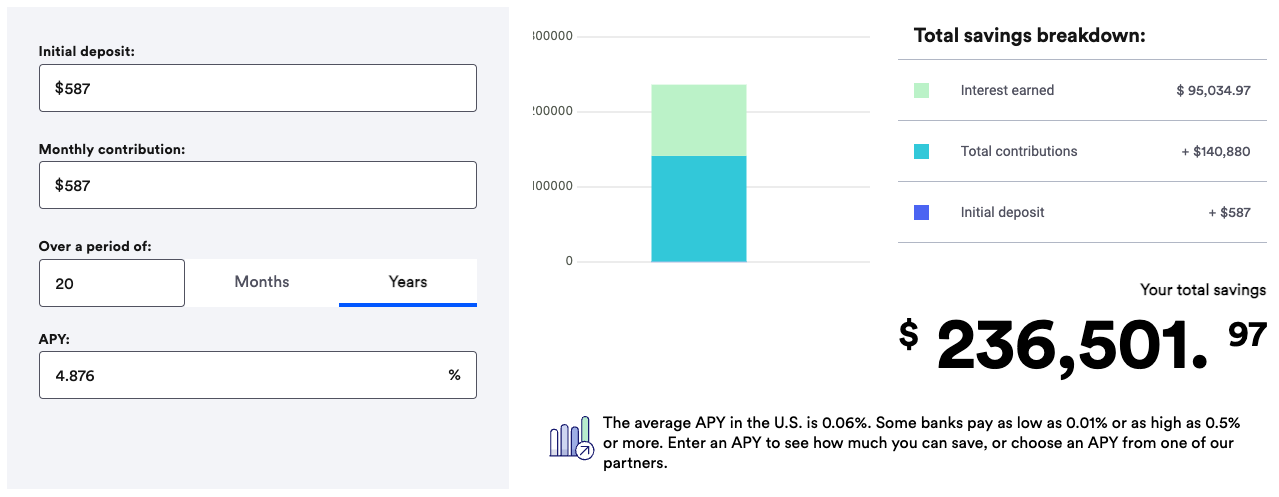

From 2003 to 2023, the Dow Jones earned 4.876% annualized returns with dividends reinvested.

Assuming the same 4.876% interest rate for the next 20 years, you would have to invest $587 per month for 20 years to accumulate $236k.

Source: Bankrate

The parent, after saving $140,880, could sell their stocks and write a check for college - and would have zero dollars left over.

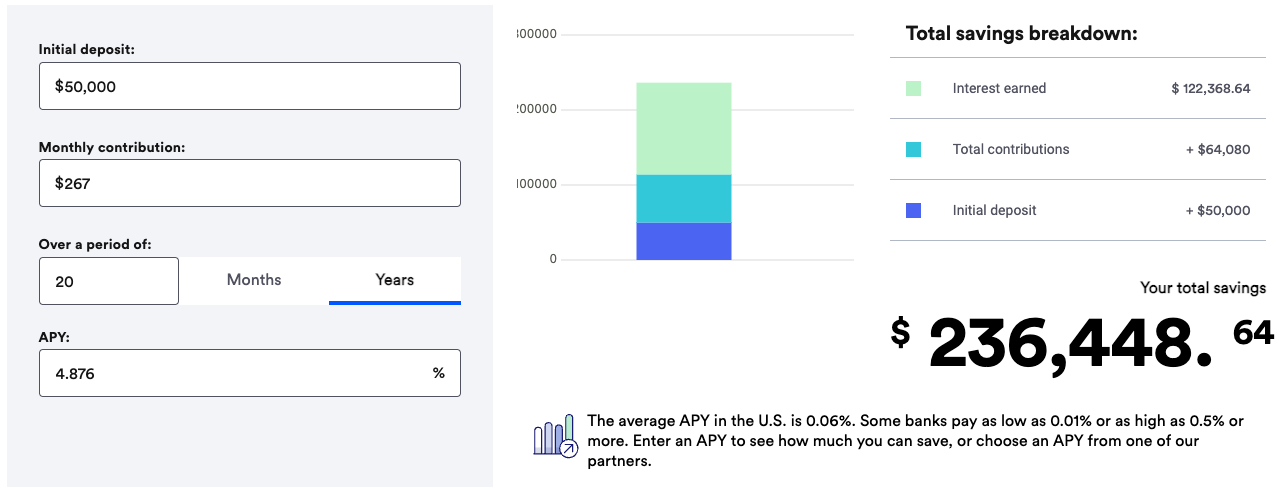

Option 3: Invest in the Stock market with a Large Down Payment

Let’s assume the parent has $50,000 cash available now and would like to kick start their college savings by investing that in the stock market. Assuming the same 4.876% interest rate for the next 20 years, after investing the initial $50,000 into the index fund, the parent would still have to deposit $267 per month for 20 years to accumulate $236k.

Source: Bankrate

The parent, after saving $114,080, could sell their stocks and write a check for college - and would have zero dollars left over.

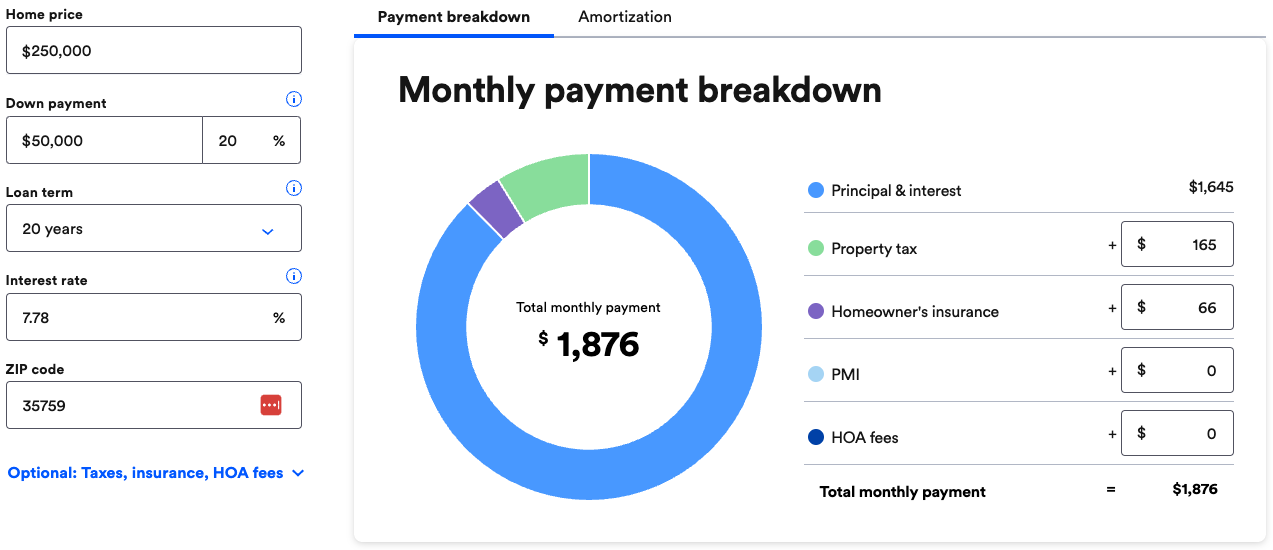

Option 4: Buy an Investment Property for $50k Down

The parent, upon the advice of their real estate agent, purchases a $250,000 investment property. The make a $50,000 down payment and take out a $200,000 mortgage. The mortgage is a 20-year, fixed rate mortgage at 7.78% interest. The monthly payment would be $1,876 per month, including taxes and insurance.

Source: Bankrate

The home rents out for $1900 per month, so every month that it is rented the owners would actually make $23.

After 20 years, that home will be paid off - right when the child goes to college.

Assuming a 2% annual rent increase per year, the home will rent for $2,768 per month in the year 2043. It would therefore “cash flow” $33,216 per year. Over the four years the child was in college, it would earn $132,864, and would have earned the $236k for the entire college cost just 3 years and 2 months after the child graduates.

The parents, after saving just $50,000 plus the cost of repairs and vacancies, could finance just over $100,000 worth of student loans, pay those off with the rents from the investment property in just over 3 years, and still own the home free and clear of mortgages. Med school, anyone?!

Assuming a 2% annual increase in home values, in 2050 that home would be worth $418,355 – with no mortgage and an annual income of over $33k per year! That is the power of real estate as an investment!

A Home for Every Child

We hope the case is clear: real estate is a very attractive option by which to save for the cost of your child’s college. It is for this reason that we advocate for “a home for every child” – an investment home. If the means are available, purchase and investment property when expecting each and every child and stop worrying about the cost of their college educations.

While homes at these prices are difficult to find in our local real estate market, they do exist in other markets. We have partners in those markets that assist our clients with finding, evaluating, and managing these homes.

Post Script: But Rates are Too High!

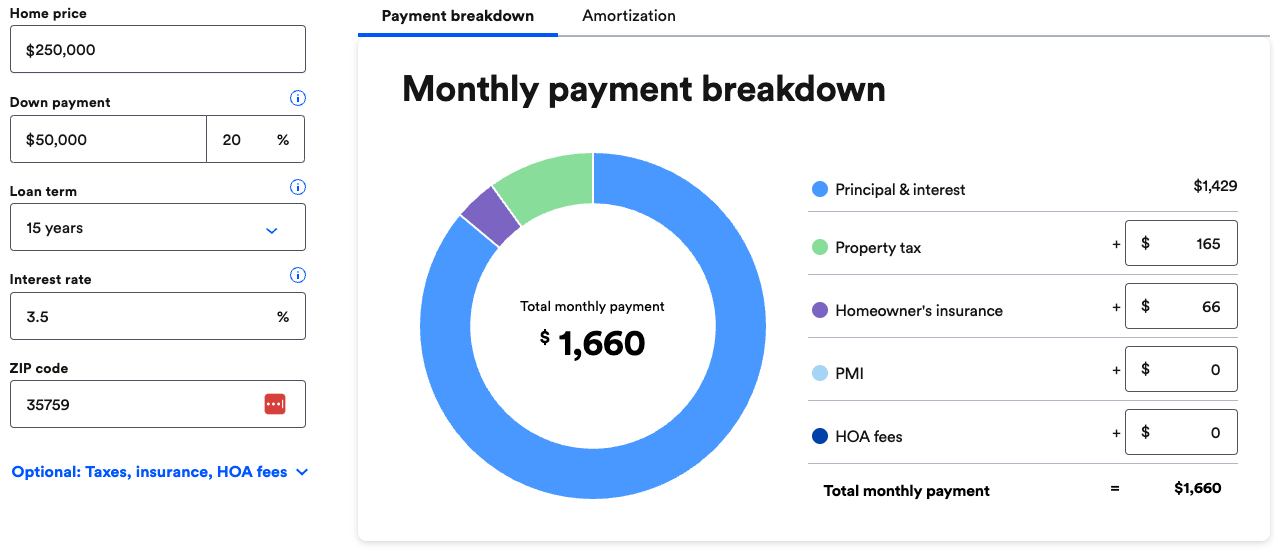

These calculations were made in September, 2023, with mortgage interest rates at a 10-year high and the numbers are still very attractive. If these calculations had been done when rates were 3.5% for investment properties, the parents could have purchased the above example home on a 15-year fixed mortgage with a monthly payment of $1660.

Source: Bankrate

After 15 years, the parents would own a home free and clear having made more than $240 per month in cash flow for those 15 years. At that point the child doesn’t even have a driver’s license yet!

By the time they are 24 and have graduated college, the total rents collected would have been $263,375 after having paid off the mortgage. The child would have no student loans and the parents would have an asset, owned free and clear, worth more than $420k that pay nearly $3000 per month!